Following last week's analysis of data center-nuclear operator partnership models, this week we examine why Saudi Arabia's ambitious Vision 2030 goals face a critical infrastructure gap that only nuclear power can fill.

The Numbers Tell a Sobering Story

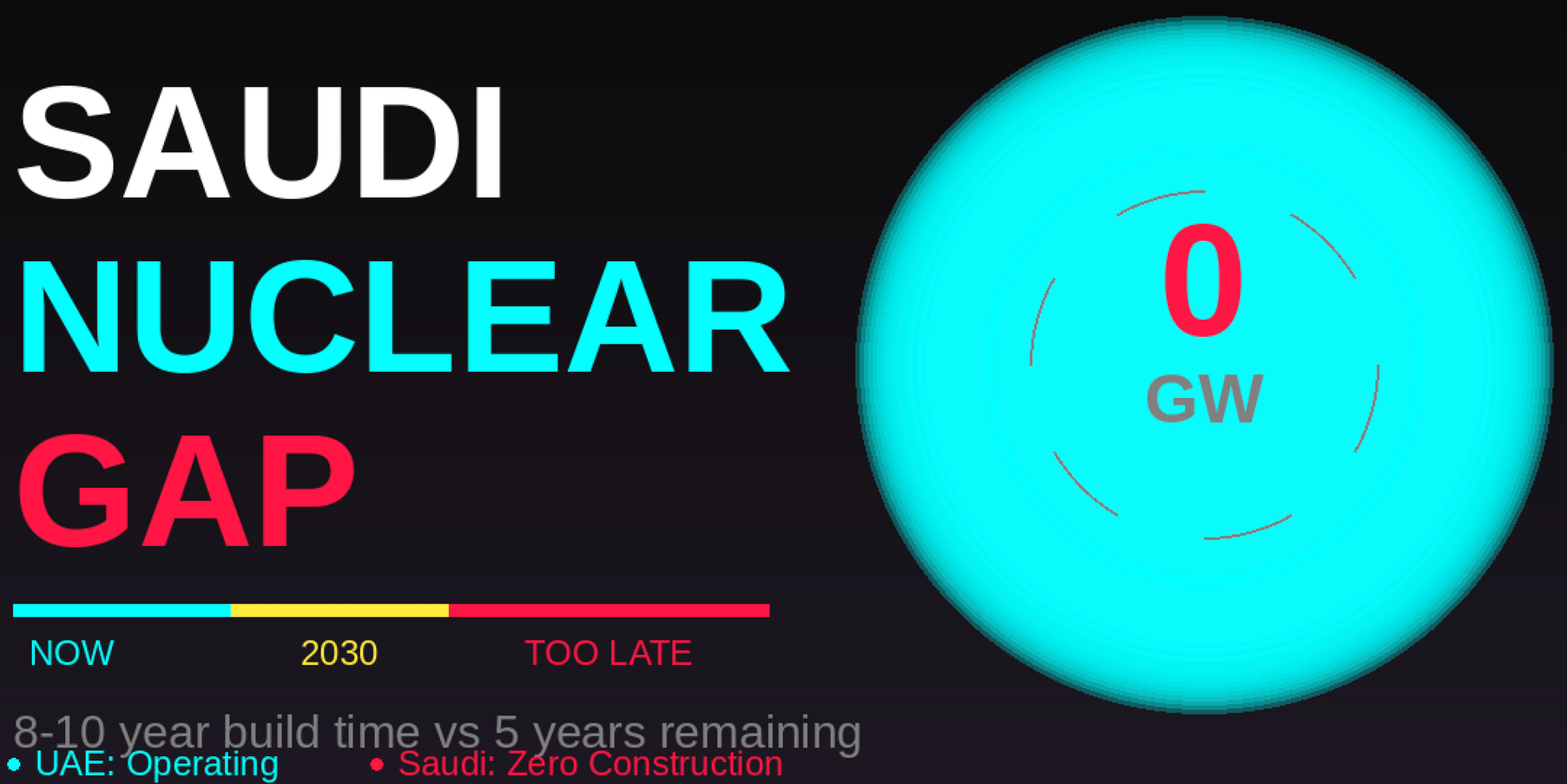

Whilst Turkey brings its first 1,200 MW Akkuyu reactor online in 2025 and Egypt accelerates construction at El Dabaa with completion targeted for 2028, Saudi Arabia operates zero nuclear capacity. The UAE's Barakah plant supplies 20 to 25 percent of national electricity with 5.6 GW across four reactors. Saudi Arabia's Vision 2030 ambitions require similar capacity. The Kingdom has not poured first concrete.

Here's the disconnect. Saudi Arabia targets 1.5 GW of data center capacity by 2030 to compete in artificial intelligence infrastructure. These facilities alone demand reliable baseload power. Traditional nuclear permitting and construction requires eight to ten years minimum, based on UAE experience. The Kingdom's first reactors target 2032 operation. The maths doesn't work.

The Problem Nobody's Discussing

King Abdullah City for Atomic and Renewable Energy announced "tangible progress" toward Saudi Arabia's first nuclear plant. Progress without construction means planning. The Kingdom solicited proposals in 2017 for 2.9 GW capacity from South Korea, China, Russia, and Japan. Eight years later, no construction permits issued. Current plans target two reactors totalling 3.2 GW by 2032.

Compare regional execution. UAE awarded contracts to Korea Electric Power Corporation in December 2009 for £15.9bn ($20bn, €18.6bn). First concrete poured July 2012. Full operation achieved September 2024. Egypt's El Dabaa targets 2028 completion from July 2022 start. Turkey's Akkuyu commenced April 2018, operational 2025. Saudi Arabia lacks signed contracts.

Data centre demands compound urgency. Saudi facilities consumed 15 billion litres of water in 2024. Gulf Cooperation Council data centres project 426 billion litres annual consumption by 2030. Saudi Arabia burns 300,000 barrels of oil daily to power desalination plants. Vision 2030 aims to reduce oil dependency whilst expanding water-intensive infrastructure. Nuclear solves both. Without it, the Kingdom exchanges one oil dependency for another.

Why Traditional Approaches Fail

Timeline Mismatch

APR-1400 reactors require six to seven years construction minimum. UAE's experience shows eight to nine years from start to operation. Saudi Arabia's 2032 target assumes immediate construction start. Current bidding suggests 2026 earliest commencement. That delivers capacity in 2034, four years past Vision 2030 deadlines.

Renewable Limitations

NEOM commits to 100 percent renewable energy. The £397bn ($500bn, €465bn) development showcases a 4 GW green hydrogen facility. Admirable for that project. Insufficient for national industrial diversification. Artificial intelligence training runs continuously. Desalination operates around the clock. Baseload nuclear complements renewables. Intermittent sources alone delay industrialisation.

Economic Reality

Saudi Arabia's National Data Center Strategy targets tripling Gulf Cooperation Council capacity from 1 GW to 3.3 GW by 2030. Powering this with natural gas increases import dependency. The Kingdom plans 60 percent gas production increase by 2030. Nuclear provides energy independence. Every year without capacity extends oil dependency.

Engineering Solutions Working Today

Solution 1: The Barakah Model Acceleration

UAE's success offers replicable lessons. Korea Electric Power Corporation built four APR-1400 units under single contract with economy of scale benefits. Each unit completed faster through learning effects. Unit 3 delivered four months faster than Unit 2, five months faster than Unit 1.

Our analysis suggests immediate expansion to four-reactor minimum commitment. South Korea, France, Russia, and China all bid competitively. Selecting proven designs cuts licensing delays. APR-1400 already operates successfully in UAE. Leveraging existing regulatory approval expedites deployment.

Solution 2: Parallel Development Strategy

Egypt pursues four reactors simultaneously at El Dabaa. First concrete poured July 2022. Unit 4 commenced January 2024. Parallel development compresses timelines. Turkey accelerated all four Akkuyu units together. Saudi Arabia should award contracts for minimum four reactors with parallel construction. International Atomic Energy Agency readiness assessments complete. No technical barriers prevent immediate action.

Solution 3: Hybrid Integration

Combining nuclear baseload with renewables maximises both. France operates 56 reactors providing 70 percent of electricity whilst expanding solar and wind. Poland develops three AP1000 reactors alongside offshore wind. Nuclear handles baseload, renewables reduce peak costs. Saudi Arabia's NEOM renewable focus works for that geography. National strategy requires nuclear backbone.

The Strategic Disconnect

The temporal disconnect between Vision 2030 deadlines and nuclear delivery timelines creates structural disadvantages for Saudi industrial diversification. Grid-scale nuclear faces eight to ten years minimum delays. Small modular reactors promise faster deployment but lack commercial track record. First deployments target late 2020s. Unproven technology introduces additional risk. Traditional large reactors offer timeline certainty if started immediately.

Regulatory Evolution Required

Saudi Arabia's September 2025 bilateral defence agreement with Pakistan opens pathways for Chinese Hualong One reactors. China National Nuclear Corporation proposed plants near Qatar and UAE borders. Four main bidders compete for Duwaiheen site. Construction should begin immediately to achieve 2032 operation.

Regulatory frameworks exist through King Abdullah City for Atomic and Renewable Energy. International Atomic Energy Agency reviews confirm readiness. No regulatory impediments prevent action. Delays stem from procurement and geopolitical negotiations regarding uranium enrichment.

The Path Forward

Vision 2030 success requires both nuclear and renewables. Three principles emerge for industrial diversification.

First, speed through proven technology. UAE's APR-1400 performance validates technology for Gulf conditions. Licensing timelines compress when precedent exists.

Second, scale through parallel development. Four-reactor minimum commitments unlock cost reductions whilst compressing timelines. Learning effects accelerate with simultaneous builds.

Third, commitment through immediate action. Every month of delay adds months to completion. Award construction contracts before 2026 to achieve capacity by 2032.

Investment Implications

Saudi Arabia's nuclear gap reshapes regional market dynamics through three channels.

First, supplier competition intensifies. Four major vendors compete for potentially the largest Middle East programme. South Korea's UAE track record provides advantage. China's cost competitiveness challenges Western suppliers. Russia's Egypt and Turkey experience demonstrates delivery. Contract values exceed £31.8bn ($40bn, €37.2bn) for four-reactor deployment.

Second, regional arbitrage opportunities emerge. Countries with operational capacity gain competitiveness advantages. UAE attracts data centre investments requiring baseload power. Egypt's 2028 completion creates similar advantages.

Third, technology lock-in shapes decades of infrastructure investment. Saudi Arabia's choice influences regional standards. Delay allows competitors to establish dominant positions.

The Bottom Line

Vision 2030 requires immediate nuclear action to succeed. Zero operational capacity today. Eight to ten years minimum construction timeline. The Kingdom needs Barakah-equivalent capacity operational by 2030 to support data centre targets, desalination requirements, and industrial diversification. That timeline passed in 2020 when construction should have commenced.

The winners in Gulf industrial competition won't be those who announce ambitious nuclear programmes. They'll be those who pour concrete, install equipment, and generate electricity. UAE achieved this. Saudi Arabia has not started.

As one energy ministry official noted privately, "We spent a decade planning the perfect nuclear programme. Our neighbours spent a decade building one."

The question isn't whether Saudi Arabia should pursue nuclear power. It's whether Vision 2030 can succeed without capacity that should already be under construction.

Next week: We map every hyperscale data center within 100km of US nuclear power, revealing proximity opportunities and grid capacity advantages that challenge conventional site selection wisdom.

The Gold standard for AI news

AI keeps coming up at work, but you still don't get it?

That's exactly why 1M+ professionals working at Google, Meta, and OpenAI read Superhuman AI daily.

Here's what you get:

Daily AI news that matters for your career - Filtered from 1000s of sources so you know what affects your industry.

Step-by-step tutorials you can use immediately - Real prompts and workflows that solve actual business problems.

New AI tools tested and reviewed - We try everything to deliver tools that drive real results.

All in just 3 minutes a day